For Buyers

Let’s get you a home that you LOVE!

You might have already been checking out properties on your own. While it’s possible to find your dream home by yourself, it’s not always the best approach. A trusted real estate agent like me can make this process easier, smoother, and faster. I will guide you through the process and ensure your success in finding your DREAM HOME

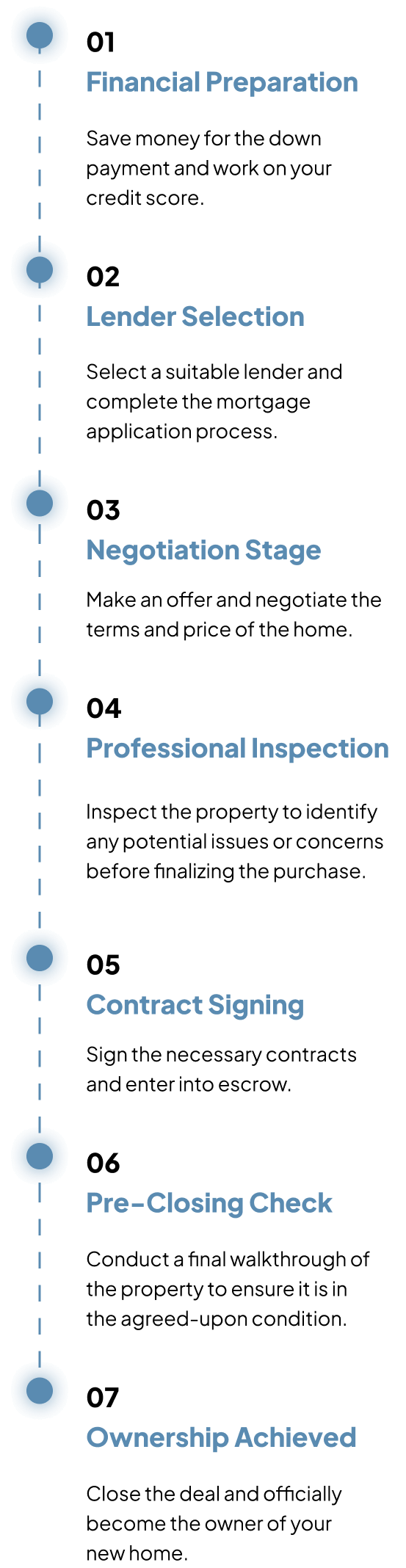

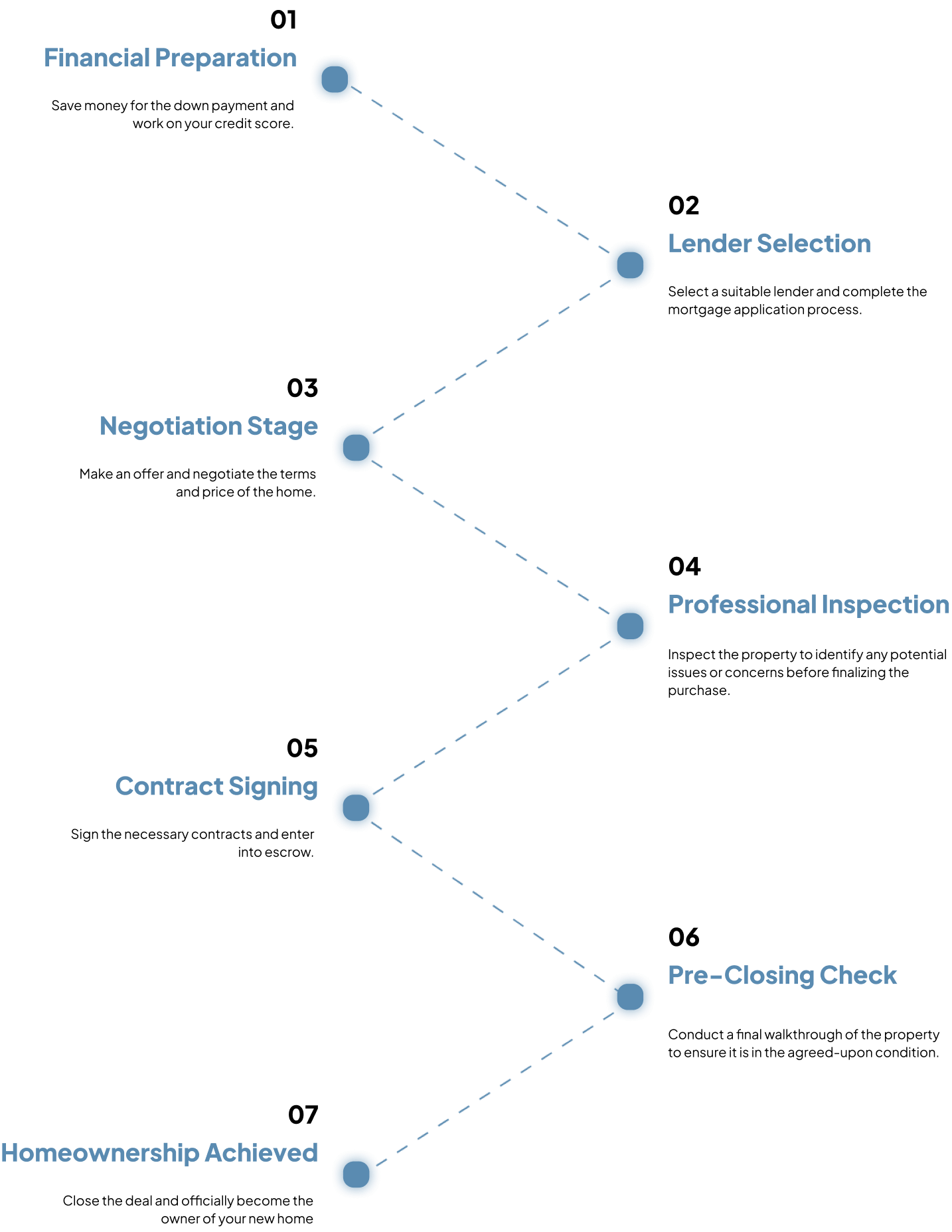

Here’s How It Works…

Buying Process Of Your DREAM HOME

Negotiate Better When Buying

Whether you’re a first-time buyer or a seasoned homeowner, this guide will provide you with all the information you need to navigate the buying process with ease. From submitting offers to closing the deal, you’ll find everything you need to know.

I’m more than just an agent!

I’m your trusted partner! I understand that the real estate process can be overwhelming, which is why I am here to take away the stress and guide you every step of the way.

Book your (No Obligation) FREE Consultation Call where I provide you with genuine advice, and suggestion and guide you in the right direction.

Let’s make your real estate dreams a reality.

Frequently Asked Questions

Getting pre-approved for a mortgage is the first step of the home buying process. Speaking with a qualified mortgage broker and getting a pre-approval letter gets the ball rolling in the right direction.

While market conditions play a role, on average, buying a home takes about 10 to 12 weeks, from searching online to closing escrow. In a hot market, it may take a little longer. Once you find your dream home and make an offer, the typical escrow period lasts 30 to 45 days. In an all-cash transaction, time tends to be less due to the absence of a lender.

No, home buyers typically don’t pay a fee to their agent. Listing brokers, who represent sellers, charge a fee to market and sell the property. Marketing may include advertising expenses such as radio spots, print ads, television, and internet ads. The property will also be placed in the local multiple listing service (MLS), where other agents in the area (and nationally) will be able to search and find the home for sale.

Agents who represent buyers (a.k.a. buyer’s agent) are compensated by the listing broker for bringing home buyers to the table. When the home is sold, the listing broker splits the listing fee with the buyer’s agent. Thus, buyers don’t pay their agents.

Most loan programs require a FICO score of 620 or better. Higher credit scores can lead to lower down payment requirements and better interest rates, while lower credit scores may require more money upfront or result in a higher interest rate.

The national average for down payments is 11%. But that figure includes first-time and repeat buyers. Let’s take a closer look.

While the broad down payment average is 11%, first-time home buyers usually only put down 3 to 5% on a home. That’s because several first-time home buyer programs don’t require big down payments. A longtime favorite, the FHA loan, requires 3.5% down. What’s more, some programs allow down payment contributions from family members in the form of a gift.

Some programs require even less. VA loans and USDA loans can be made with zero down. However, these programs are more restrictive. VA loans are only made to former or current military servicemembers. USDA loans are only available to low to-middle income buyers in USDA-eligible rural areas.

For many years, conventional loans required a 20% down payment. These types of loans were typically taken out by repeat buyers who could use equity from their existing home as a source of down payment funds. However, some newer conventional loan programs are available with a 3% down if the borrower carries private mortgage insurance (PMI).

If the built-up equity in your current home will be applied to the down payment on the new home, naturally the former will need to be sold first.

Some home buyers decide to turn their current home into an investment property by renting it out. In that case, the current home will not need to be sold. However, your loan advisor will still need to evaluate your risk profile and credit history to determine whether making a loan on a new home is feasible while retaining title to the old home.

Buyers often have a short time frame to sell their current home when relocating to a new city because of a job transfer. If you are moving but taking a position with the same employer, check to see if they offer relocation assistance to help offset some of the costs.

That’s up to you! For sure, home shopping today is easier today than ever before. The ability to search for homes online and see pictures, even before setting a foot outside the comfort of your living room, has completely changed the home buying game. Convenience is at an all-time high. But, nothing beats visiting a home to see how it looks and ‘feels’ in person.